When a person dies leaving assets in South Australia, a legal personal representative may need to apply to the Court for a grant through the Electronic System hereinafter called CourtSA.

Any reference to a rule is referring to Chapter 25 of the Uniform Civil Rules 2020.

The Probate Registry of the Supreme Court of South Australia issues grants recognising that appointment of a legal personal representative. There must be an asset in South Australian for the Probate Registry to have jurisdiction to issue a grant – rule 356.17(1).

There are a number of ways to obtain a grant. You may either:

- instruct a lawyer to act on your behalf;

- authorise the Public Trustee to act as administrator;

- consent to a trustee company acting as executor or administrator; or

- make the application yourself as a personal applicant (without a lawyer).

If you have elected to proceed as a personal applicant it is strongly recommended you consider rule 351.8.

The questions asked in an application on CourtSA do not cover all possible situations and it may be that when your application is examined further issues will be raised.

Depending on the type, size and value of the assets it may not be necessary to obtain a grant in South Australia. There is no statutory requirement to obtain a grant in every case.

The Court does not decide whether a grant is required to administer the estate.

A grant is required when a third party (e.g. Land Services SA, nursing homes, banks, company share registries etc) will not release the asset without a formal grant from the Probate Registry. The grant provides assurance to the third party of the appointment of the legal personal representative.

Some third parties will release an asset without the need for a grant. You should contact each third party to ascertain whether a grant is required to release the asset.

The nature and extent of the assets of the deceased

In some circumstances deceased estates can be administered informally (that is, without a grant). Some organisations, such as banks and insurance companies, may release money without seeing a grant if the amount held in the name of the deceased is minimal and there are no complications. However, conditions may be imposed.

If the deceased owned real estate either solely or as a tenant in common

Land Services SA will not process a transfer of the deceased’s sole interest or an interest as a tenant in common in real estate without a grant.

If the assets are jointly owned

If the deceased’s assets are held in a joint tenancy then, the provision of a death certificate may be enough for the deceased’s interest to be transferred to the surviving joint holder.

The requirements of a superannuation fund to pay out a death benefit

Superannuation trustees may pay the funds direct to a nominee pursuant to a binding death benefit nomination. If the nomination lapses or is invalid, the trustees may choose to pay the funds to a specific person (for example, a spouse or dependants) or to the deceased’s estate.

Registry staff cannot provide assistance with queries regarding superannuation. You will need to contact the superannuation fund.

You need to decide the type of grant required for your circumstance. The Probate Registry does not make this initial decision for you.

Below are the main types of grants and the fundamental requirements for each:

A Grant of Probate

- There is a Will (referred to in the Rules as a ‘testamentary document’) with a valid appointment of executor(s) and you are the/one of the executors named in the Will.

- Refer to rule 356.2 and rule 356.5 for the marking of the Will.

A Grant of Letters of Administration with the Will annexed

- There is a Will but no appointment of executors or the executorial appointment does not operate and a person other than the executor applies for a grant as the administrator.

- Refer to rule 356.3 for the order of priority of who can apply as the administrator and rule 356.4 for making that application and rule 356.5 for the marking of the will

A Grant of Letters of Administration

- There is no Will and you are the person highest in priority to claim a grant.

- Refer to rule 356.15 for the order of priority.

Registration or Reseal of a grant

- You have a grant from an interstate Court or an overseas grant and you require the interstate grant to be registered or the overseas grant to be resealed in South Australia to deal with the assets here.

- Refer to Section 57 of the Succession Act 2023 (SA) and rule 356.31 for registration of an interstate grant and rule 356.32 for the reseal of an overseas grant.

A word of caution before you proceed if you are not represented by a lawyer and intend to make your application personally as a – personal applicant

A personal application is likely to be far more onerous than your friends and family may tell you. Making an application for a grant is not simply a matter of filling in forms and paying the Court fee.

Considerations for personal applicants

The person or persons applying for a grant should also be aware that:

- the Rules of the Court preclude Registry staff giving legal advice;

- documents leading to the grant require various undertakings to the Court;

- the correct administration of a deceased estate may involve the application of technical legal rules;

- applying for probate and administering an estate are technical processes that require an understanding of the law and both Court practice and Court procedure;

- there may be taxation consequences and responsibilities arising from the administration of the trust estate; and

- an executor or administrator may be personally liable for both breach of trust and damages arising from negligence.

Difficulties frequently encountered in an application for a grant include:

- paper clip marks or additional staple holes in the Will;

- a signature of the person who made the Will where the signature is not clear or which suggests frailty;

- the absence of a date to the Will;

- the date of the Will being obscured, incomplete or altered without authentication;

- the absence of an attestation clause in the Will or an insufficient attestation clause in the Will;

- the use by the person who made the Will and the witnesses to the Will of different pens thereby raising doubt on whether all present together when the Will was executed; and

- any alteration to the text of the Will without authentication. Refer to section 16 of the Succession Act 2023 (SA).

These difficulties require additional affidavit evidence which may involve technical research and take considerable time.

If you have any doubt about your legal position and responsibilities, then you should obtain legal advice from a lawyer who specialises in Wills and deceased estate administration. The Law Society of South Australia at 178 North Terrace, Adelaide, 5000 can provide you with a list of such lawyers. Telephone: (08) 8229 0200.

The information below sets out the minimum documentation needed to make an application for a grant of probate or, letters of administration with the Will annexed or letters of administration without the Will.

Depending on your circumstance, you may need to provide additional information.

Probate

Refer to rule 356.2

If you are making an application for a grant of probate then, the minimum documentation you need to complete the CourtSA Grant Application form is:

- Original Will and any Codicil(s)

The original Will and any Codicil(s) – (a codicil is an addition to the Will that changes the Will in some way) MUST be marked accordance with rule 356.5(2) before being lodged in the Probate Registry. View also Step 7 for more information about lodging the Will and any Codicil(s).

It is very important that you do not remove any staples or clips holding the Will and Codicil(s) (if any) together.

When you scan the Will to upload a copy to your grant application DO NOT REMOVE THE STAPLE(S). If the staples or clips have already been removed, do not re-staple or clip the Will and Codicil(s) (if any).

The scanned copy of the Will and any Codicil(s) must be as one document and not separate pages. For more information about why this is important, view here.

Ensure that you have the Will and any Codicil(s) accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

- Death certificate

The death certificate uploaded to the application must be a true and complete copy of the original, AND BOTH SIDES must be scanned and uploaded and one document.

Ensure that you have the death certificate accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

An interim death certificate is acceptable.

If the person died outside Australia then refer to rule 356.18(3) . View help if deceased died outside Australia.

- All executors must be cleared off or accounted for

The applicant for a grant is considered a ‘proving executor’ whereas the executor(s) named in the Will who is not proving the Will, nor seeking to administer the estate is considered a ‘non-proving executor’.

It is not necessary for all executors named in the Will to apply for probate. Any one or more may apply. The Court will not wait for all executors to apply before granting probate.

Refer to rule 356.2(4).

An executor named in the Will has died:

- If an executor at the same or higher order of priority to the applicant has died, their name and date of death must be recited in the application.

An executor wishes leave to be reserved to them:

- ‘Leave reserved’ is the description where the executor is not applying for a grant of probate but reserves their right to take a grant in the future. They are considered a ‘non-proving executor’.

- Where there is one or more executors who have not applied for probate and leave has been reserved to them, they can make an application for a double grant of probate at a later date.

The executor is unwilling to act and has renounced:

- An executor (or person entitled to administer an estate) can formally relinquish all their right and entitlement to obtain a grant and administer the estate. For an executor to renounce they must complete the appropriate Renunciation form.

- If an application for a grant is going to be filed, a renunciation in the prescribed form must be uploaded to the application leading to the grant.

- If an application for a grant has not been commenced and you wish to renounce your entitlement, you may do so by completing the Renunciation Application through CourtSA. Please be aware that the original Will and any Codicil(s)must be lodged with the Probate Registry upon lodging the renunciation.

Forms to renounce:

The relevant form should be completed before lodging via CourtSA:

- Form PROB16 – Renunciation of probate where an executor (who is an individual) named in the Will wishes to renounce;

- Form PROB21 Renunciation of probate by a trust corporation where the executor is a trust corporation named in the Will wishes to renounce;

The executor is unable to act:

There may be cases where the executor named in the Will at same or higher order of priority does not have the mental or physical capacity to administer the estate. An affidavit must be provided by one of the Applicants annexing a letter form the executor’s treating doctor indicating the length of time the doctor has been treating the executor that is unable to act, the nature of the mental or physical disability of that executor that impedes an ability to undertake the duties of an executor and the prognosis.

- Details of the assets and liabilities of the deceased person

You must provide a description and value of all assets and liabilities as at date of death of the deceased, including those located interstate and if the deceased died domiciled in Australia, their assets overseas. Assets include interests in real estate, house contents, money in bank accounts, investments, motor vehicles and other possessions – but excluding any assets owned with another as joint tenants.

Liabilities include legal expenses, tax, mortgages or other debts existing at date of death but not funeral expenses.

Refer to Section 71 Succession Act 2023 (SA), rule 356.17 and Practice Note 3 of 2024.

- 100 points of identification for personal applicants

You must provide the Probate Registry with verification of your identity. This can be completed by an authorised witness being one of the following:

(a) the Registrar (2.1—Definitions) of the Court;

(b) a justice of the peace;

(c) a notary public;

(d) a Commissioner for taking affidavits;

(e) a police officer, other than a police officer who is a probationary constable; and

(f) any other person authorised by law to take affidavits.

Refer to rule 351.8 and the Practice Note 4 of 2024 for the requisite documents and a list of acceptable documents for 100 points of ID.

Ensure that you have the verification of identity accessible and saved on your computer in PDF format can upload it as you complete the CourtSA Grant Application form.

- Credit card to pay the lodgement fee

To submit your application, you need a credit card to pay the Court fee.

Letters of Administration with the Will annexed

Refer to rule 356.3

If you are making an application for a grant of letters of administration with the Will annexed, the minimum documentation you need to complete the CourtSA Grant Application form is:

- Administrator’s oath

For help on which oath to prepare, view here. If after reading the page about administrator’s oaths you still do not know which one you need then you must seek legal advice from a lawyer. Registry staff cannot provide legal advice.

You need to upload to the application a signed and duly witnessed oath. Refer to rule 356.4, rule 356.5 and consider rules 356.6 -356.12. See also Notes to Form PROB34 for guidance on the requirements of a duly signed and witnessed oath/affidavit.

Ensure that you have the signed oath accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form

- Original Will and any Codicil(s)

The original Will and any Codicils – (a codicil is an addition to the Will that changes the Will in some way) MUST be marked accordance with rule 356.5 before being lodged in the Probate Registry. See Step 7 for more information about lodging the Will and any Codicil(s).

It is very important that you do not remove any staples or clips holding the Will and Codicil(s) (if applicable) together.

When you scan the Will and Codicil(s) (if applicable) to upload a copy to your grant application DO NOT REMOVE THE STAPLES. If the staples or clips have already been removed, do not re-staple or clip the Wil and Codicil (if applicable).

The scanned copy of the Will and any Codicil(s) must be as one document and not separate pages. For more information about why this is important, view here.

Ensure that you have the Will and any Codicil(s) accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

- Death certificate

The death certificate uploaded to the application must be a true and complete copy of the original, AND BOTH SIDES must be scanned and uploaded as one document.

Ensure that you have the death certificate accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

An interim death certificate is acceptable.

If the person died outside Australia then refer to rule 356.18(3). View here for more information.

- All executors must be cleared off or accounted for

Your oath leading to the grant must establish your entitlement to a grant and clear off all persons entitled at a higher order.

Refer to rule 356.3.

An executor named in the Will has died:

- If an executor at the same or higher order of priority to the applicant has died, their name and date of death must be recited in the oath.

The executor has renounced:

- An executor (or person entitled to administer an estate) can formally relinquish all their right and entitlement to obtain a grant and administer the estate. For an executor to renounce they must complete the appropriate Renunciation form.

- If an application for a grant is going to be filed, a renunciation in the prescribed form must be uploaded to the application leading to the grant.

- If an application for a grant has not been commenced and you wish to renounce your entitlement, you may do so by completing the Renunciation Application through CourtSA. Please be aware that the original Will and any Codicil(s) must be lodged with the Probate Registry upon lodging the renunciation.

Forms to renounce:

The relevant form should be completed before lodging via CourtSA:

- Form PROB17 Renunciation of letters of administration with Will annexed where a person entitled to a grant of letters of administration with the will annexed wishes to renounce;

- Form PROB20 – Renunciation of letters of administration with Will annexed to the syndic of a company or body corporate not being a trust corporation where a Company is the executor named in the Will wishes to renounce.

The executor is unable to act:

- If an executor named in the Will (at the same or a higher level of priority as the applicant) is unable to act, evidence of why they cannot act is required.

- Where the inability is on medical grounds, a copy of:

- a letter from a treating doctor; or

an order made by the Guardianship Board or SACAT - should be annexed to an affidavit of the applicant.

- a letter from a treating doctor; or

- Where the inability is for other reasons, those reasons should be stated in an affidavit and any supporting documentation annexed. The affidavit(s) should be scanned and uploaded to your CourtSA application.

- Details of the assets and liabilities of the deceased person

You must provide a description and value of all assets and liabilities at date of death of the deceased, including those located interstate and if the deceased died domiciled in Australia, their assets overseas. Assets include interests in real estate, house contents, money in bank accounts, investments, motor vehicles and other possessions – but excluding any assets owned with another as joint tenants.

Liabilities include legal expenses, tax, mortgages or other debts existing at date of death but not funeral expenses.

Refer to Section 71 Succession Act 2023 (SA), rule 356.17 and Practice Note 3 of 2024.

- 100 Points of identification for personal applicants

You must provide the Probate Registry with verification of your identity. This can be completed by an authorised witness being one of the following:

(a) the Registrar (2.1—Definitions)of the Court;

(b) a justice of the peace;

(c) a notary public;

(d) a Commissioner for taking affidavits;

(e) a police officer, other than a police officer who is a probationary constable; and

(f) any other person authorised by law to take affidavits.

Refer to rule 351.8 and the Practice Note 4 of 2024 for the requisite documents and a list of acceptable documents for 100 points of ID.

Ensure that you have the verification of identity accessible and saved on your computer in PDF format can upload it as you complete the CourtSA Grant Application form.

- Credit card to pay the lodgement fee.

To submit your application, you need a credit card to pay the Court fee.

Letters of Administration without the Will

Refer to rule 356.15

If you are making an application for letters of administration without the Will, then the minimum documentation you need to complete the CourtSA Grant Application form is:

- Administrator’s oath

For help on which oath to prepare, view here. If after reading the page about administrator’s oaths you still do not know which one you need then you must seek legal advice from a lawyer.

Registry staff cannot provide legal advice.

You need to upload to the application a signed and duly witnessed oath. Refer to Practice Note 1 of 2024, rule 356.17 and Notes to Form PROB34 for guidance on the requirements of a duly signed and witnessed oath/affidavit.

Ensure that you have the signed oath accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

- Death certificate

The death certificate uploaded to the application must be a true and complete copy of the original, AND BOTH SIDES must be scanned and uploaded as one document.

Ensure that you have the death certificate accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

An interim death certificate is acceptable.

If the person died outside Australia refer to rule 356.18(3). View here for more information.

- Details of the assets and liabilities of the deceased person

You must provide a description and value of all assets and liabilities at date of death of the deceased, including those located interstate and if the deceased died domiciled in Australia, their assets overseas. Assets include interests in real estate, house contents, money in bank accounts, investments, motor vehicles and other possessions – but excluding any assets owned with another as joint tenants.

Liabilities include legal expenses, tax, mortgages or other debts existing at date of death but not funeral expenses.

Refer to Section 71 Succession Act 2023 (SA), rule 356.17 and Practice Note 3 of 2024.

- 100 Points of identification for personal applicants

You must provide the Probate Registry with verification of your identity. This can be completed by an authorised witness being one of the following:

(a) the Registrar of the Court;

(b) a justice of the peace;

(c) a notary public;

(d) a Commissioner for taking affidavits;

(e) a police officer, other than a police officer who is a probationary constable; and

(f) any other person authorised by law to take affidavits.

Refer to rule 351.8 and the Practice Note 4 of 2024 for the requisite documents and a list of acceptable documents for 100 points of ID.

Ensure that you have the verification of identity accessible and saved on your computer in PDF format can upload it as you complete the CourtSA Grant Application form.

- Credit card to pay the lodgement fee

To submit your application, you need a credit card to pay the Court fee.

Registration of an interstate grant or Reseal of overseas grant

Refer to rule 356.31 for registration of an interstate grant and rule 356.32 of reseal of an overseas grant

If you are making an application for registration of an interstate grant or reseal of an overseas grant then the minimum documentation you need to complete the Grant Application form on CourtSA is:

- Original interstate or overseas grant or a duly authenticated copy of that grant)

It is very important that you do not remove any staples or clips holding the original Grant or the duly authenticated copy of that grant.

When you scan the original Grant or an duly authenticated copy of that grant to upload a copy to your grant application DO NOT REMOVE THE STAPLES. If the staples or clips have already been removed, do not re-staple or clip the original Grant or the duly authenticated copy of that grant.

The scanned copy of the original or the duly authenticated copy of that grant must be as one document and not separate pages. For more information about why this is important, view here.

Ensure that you have the original Grant or the duly authenticated copy of that Grant accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

- Death certificate

The death certificate uploaded to the application must be a true and complete copy of the original, AND BOTH SIDES must be scanned and uploaded as one document.

Ensure that you have the death certificate accessible and saved on your computer in PDF format so you can upload it as you complete the CourtSA Grant Application form.

An interim death certificate is acceptable.

If the person died outside Australia refer to rule 356.18(3). View here for more information.

- Details of the assets and liabilities of the deceased person

You must provide a description and value of all assets and liabilities located in South Australia as at date of death. Assets include interests in real estate, house contents, money in bank accounts, investments, motor vehicles and other possessions – but excluding any assets owned with another as joint tenants.

Liabilities include legal expenses, tax, mortgages or other debts existing at date of death but not funeral expenses.

Refer to Section 71 Succession Act 2023 (SA), rule 356.17 and Practice Note 3 of 2024.

- 100 Points of identification for personal applicants

You must provide the Probate Registry with verification of your identity. This can be completed by an authorised witness being one of the following:

(a) the Registrar of the Court;

(b) a justice of the peace;

(c) a notary public;

(d) a Commissioner for taking affidavits;

(e) a police officer, other than a police officer who is a probationary constable; and

(f) any other person authorised by law to take affidavits.

Refer to rule 351.8 and the Practice Note 4 of 2024 for the requisite documents and a list of acceptable documents for 100 points of ID.

Ensure that you have the verification of identity accessible and saved on your computer in PDF format can upload it as you complete the CourtSA Grant Application form.

- Credit Card to pay the lodgement fee

To submit your application, you need a credit card to pay the Court fee.

If you have elected to proceed as a personal applicant it is strongly recommended you consider to Practice Note 4 of 2024.

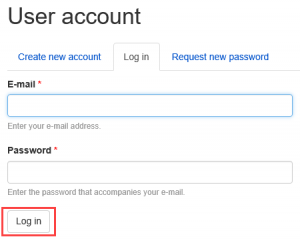

You will need to have registered an account in CourtSA.

- Enter the E-mail and Password you used when registering for a CourtSA account.

- Click Log in.

The CourtSA Grant Application form takes you through a series of questions so that the Court can assess your application.

Be aware that the questions on CourtSA do not cover all possible situations and it may be that when your application is assessed further issues will be raised.

Your answers will be used in the Court generated documents, so make sure you type them exactly as you would like the words to appear in the official documents.

As you fill out the form, you will be provided with information to help you as well as links to further information contained in this website.

You can save the form as a draft if you need to, and finish it when you are ready.

If you don’t know how to answer a question, and you can’t find the answer on the form or on this website, you should get advice from a lawyer.

Registry staff cannot provide legal advice.

When you have completed your application on CourtSA make sure that you check your application carefully. The system will not correct spelling and grammatical mistakes, nor can it automatically tell if an incorrect document has been uploaded.

When that check is completed, simply press “Proceed” to submit the form.

CourtSA will then take you to the payments page.

If you have made a mistake in your lodgement you need to email the Probate Registry as soon as possible to inform of the mistake. Registry staff will then determine and notify the appropriate course.

- For applications for Probate or Letters of Administration with the Will annexed you must lodge in the Probate Registry the original document (Will and Codicil(s) (if applicable))

- For applications for registration of an Interstate grant or the reseal of an overseas grant, you must lodge in the Probate Registry the original Grant or duly authenticated copy of that grant.

After lodging your grant application CourtSA will automatically create an Original Will Coversheet.

- Print the original Will Coversheet from the Documents Tab in the application.

- In the space provided on the original Will Coversheet provide details of what will be enclosed in the envelope.

- Affix (glue or sticky tape) the printed original Will Coversheet on an A4 envelope.

- Place the original Will and any Codicil(s) marked in accordance with rule 356.5 or the Court authenticated grant for registration or reseal with the Certificate of Identity in the envelope without folding it.

- Lawyers and personal applicants – Lodge the original Will and any Codicil(s) or the original Grant or duly authenticated copy of that grant either in person or by registered post to the Probate Registry, Sir Samuel Way Building, 241-259 Victoria Square Adelaide 5000.

Your application will not be considered until the original Will and any Codicil(s) / original Grant or duly authenticated copy of that grant and certificate of identity (for personal applicants) has been lodged.

- Personal applicants must lodge their original Certificate of Identity with the Registry

- The original Will and any Codicil(s) / original Grant or duly authenticated copy of that grant is NOT to be taken apart (staple or clip removed) for the purposes of photocopying or scanning.

Assessment of your application for a grant

- Once you have paid the Court fee a file is created and given a ‘PROB’ number. This is your unique identifier and means the application has been received by the Probate Registry.

- Until you lodge the original Will and any Codicil(s) or the original documents for registration/resealing your application (as the case requires) will not be considered.

- The Probate Registry officers’ examine the application to ensure it complies with the relevant rules and legislation. Receiving a grant is not an automatic process.

- If the examining officer has any questions on your application a requisition will be sent to you by email. If you do not understand what is being asked of you, you need to seek legal advice. Do not call the Court. Neither Registry staff nor the examining officer can tell you what to write or how to proceed.

- Once all requisitions have been answered and the examining officer is satisfied the application complies with all requirements the grant will issue.

Once the grant issues it will often be necessary to provide a copy of the grant to financial or other institutions to prove you are the person authorised by the Court to administer the estate. You can download and print copies of the grant from CourtSA but the financial or other institution must satisfy itself as to the authenticity of the grant.

You will be notified by email when the Grant and Registrar’s Certificates of Disclosure have been issued.

The original grant is the electronic document located in CourtSA, which you then download. Paper grants are not issued.

The role of the Probate Registry ends when the grant issues. The estate administration is then the responsibility of the legal personal representative named in the grant.